GENTING Highlands latest update

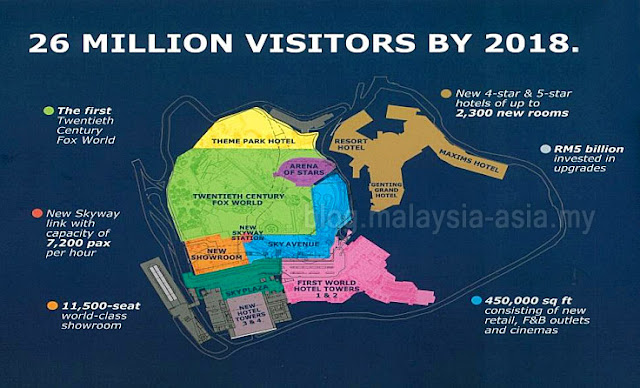

Great news for shoppers as Malaysia's second premium outlet center called Genting Premium Outlets or GPO is set to open in late 2016 May 2017 up at Genting Highlands or Resorts World Genting as it is now known. 2016 will be an amazing year for Genting as a number of new attractions are set to open all the way till 2017 where the much talked about first ever 20th Century Fox World theme park will open here as well.

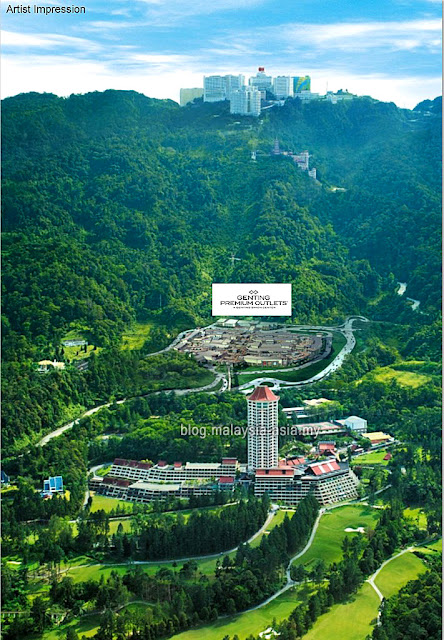

Genting Premium Outlets will also be located near the Awana Resort and Golf Course, which is a little more than half way up to Resorts World Genting. A gross area of about 600,000 square feet that will house 150 designer brands and also local brand name stores will be available to suit the Southeast Asian market and there will be an allocation of 4,000 parking bays for cars and buses here.

Shoppers can expect brands like Aigner, BCBGMAXAZRIA, Burberry, Canali, Coach, Ermenegildo Zegna, Furla, Guy Laroche, Michael Kors, Polo Ralph Lauren, Salvatore Ferragamo, Swatch, Tumi and more here. At GPO, you will also find retail shops selling sportswear, fine leather, luggage, housewares, home furnishings, fashion accessories and more.

The first phase of the Genting Premium Outlets will cover an estimate area of 300,000 square feet and is expected to be ready in 2016. A new food street area is also planned around the GPO and in total, the company is expecting around 4 million or more tourist a year. The second phase of the project would kick off in the next three to five years whereby another 40 brands would be included with a built up area of 80,000 square feet.

Shoppers can expect brands like Aigner, BCBGMAXAZRIA, Burberry, Canali, Coach, Ermenegildo Zegna, Furla, Guy Laroche, Michael Kors, Polo Ralph Lauren, Salvatore Ferragamo, Swatch, Tumi and more here. At GPO, you will also find retail shops selling sportswear, fine leather, luggage, housewares, home furnishings, fashion accessories and more.

|

| Genting Premium Outlets is located next to Awana Resort and Golf Club |

GPO will cost about RM200 million and this will be Southeast Asia’s first hilltop Premium Outlet Centre and Malaysia's second Premium Outlets Store after Johor Premium Outlets or JPO. This is also not the last as there are plans for a third Premium Outlet in the north of Malaysia in time to come.

About Genting Premium Outlets GPO

Genting Simon Sdn Bhd is a unit of Simon Genting Ltd, a 50:50 joint venture between Genting Plantations Bhd and Premium Outlets, the outlet division of Simon Property Group. The centre will be operated by GSSB, a wholly owned subsidiary of Simon Genting Ltd (SGL). GPO is also the 85th Premium Outlet Center in the Premium Outlets portfolio, development for Genting Premium Outlets is targeted for completion in the last quarter of 2016.

How to go to Genting Premium Outlets GPO

Genting is located about one to one and a half hours drive from Kuala Lumpur city center. There are various methods to get here and all of them are via road only. Unless you have a big wallet, you can charter a helicopter from KL to fly there in probably 15 minutes. Below are the ways to go to Genting Premium Outlets at Genting Highlands.

Car - Self driving is probable the best and easiest way to get here. From Kuala Lumpur, you need to take the MRR2 or Middle Ring Road towards the East Coast Highway or Karak Highway. The turn off to Genting is just before the main tunnel. I would strongly recommend you use Waze or GPS for first timers. One way drive time is around 60-80 minutes.

Taxi - There are numerous taxi companies that offer KL-Genting services. One way would cost you about RM100 for 1-4 persons. Taxis include standard taxis which you can stop anywhere, executive taxis, Genting Taxis, radio call taxis and hotel taxi or limousine services.

Taxi from KLIA and KLIA2 - There are a number of taxis that will gladly take you up to Genting Highlands, but the price will cost anywhere from RM250 to RM350 per taxi and 4 persons max. There is also a Limousine service where prices are from RM3000 or more. Alternatively, there is the SkyVan which can seat 6-8 persons and this will cost around RM450 to RM600.

Bus - A number of bus companies offer KL to Genting or PJ to Genting and back services. You can find most of the buses at Puduraya Bus Station near Chinatown KL, Duta Bus Terminal or in Petaling Jaya, One Utama Shopping Center Bus Terminal. The price is around RM12 one way per person and time taken is about 80-100 minutes one way.

Cable Car - Note that most bus services stop at the main cable car station where you will continue your journey via cable car the rest of the way. A great experience for 1st timers but if you want to go all the way to the top, you need to double check with the taxi or bus company if ticket is all the way or just half way.

Helicopter - For the well heeled, this is a quick option up there which is only 15 minutes. But special arrangements need to be done for this service in advance which can cost anywhere from RM3000 on wards. You need to contact Resorts World Genting to make this arrangement.

Overall, if you need more help on transportation to Resorts World Genting, please contact Genting Transport Reservations Centre - Tel: (603) 6251 8398

|

| The Genting Integrated Tourism Plan layout |

source: http://blog.malaysia-asia.my/2015/11/genting-premium-outlets-gpo.html

Iskandar (photo) said the affordable units are priced between RM230,000 and RM270,000, compared to Soho or Sovo units which are priced between RM450,000 and RM500,000.

Iskandar (photo) said the affordable units are priced between RM230,000 and RM270,000, compared to Soho or Sovo units which are priced between RM450,000 and RM500,000.