Property taxes are a certainty that all property owners must face. There are taxes for every step of the way- during the purchase of property, owning of property and of course, the selling (or transferring) of property.

How many of us can say that we know exactly what taxes there are, when do they apply and how much should be paid? Perhaps property agents, lawyers or some accountants may know the complexities of taxes involved with property, but the average Malaysian will face certain frustration when the word “taxes” even comes to mind.

This simple guide aims to give property owners a better idea of what are the most common taxes, under what circumstances they apply as well as how to calculate them throughout the different stages of buying, owning to the letting go of property.

Purchasing a Property

1. Stamp Duty

During the purchase of a property, there is a ton of paper work involved, which is already quite overwhelming in itself. Stamp duty makes things a little more complicated (and costly) to purchase a property.

Stamp duty is imposed on the ‘instrument of transfer’ (or documents) related to the purchase or transfer of the property, which is paid for by the buyer. These include the Sales and Purchase Agreement (S&P) and Memorandum of Transfer (MOT), and even loan documents.

The Inland Revenue Board stipulates that the amount of stamp duty is levied upon the value of the property, determined by (whichever higher):

(i) The property’s market value.

(ii) The property’s selling price.

(ii) The property’s selling price.

Example:

Property price based on market value: RM600,000

Property price based on selling price: RM550,000

Property price based on selling price: RM550,000

So the amount that stamp duty will be levied on is RM600,000 (the higher amount of the two).

Calculating stamp duty:

Based on the example of a property valued at RM600,000:

*Note: Stamp duty is also imposed on the documents of loans taken to purchase properties. If you take a loan to purchase the property, you will have to pay 0.5% of the loan amount on top of that.

2. Goods and Services Tax (GST) - Commercial Properties

GST is a fixed 6% tax imposed on goods and services in Malaysia beginning from 1st April 2015. In terms of property purchasing, GST of 6% is applicable when you (buyer) purchase a commercial property from an individual who is GST-registered.

Criteria of commercial property owners who have to be GST-registered:

(i) Own 2 or more commercial properties.

(ii) Own land larger than 1 acre.

(iii) Own a commercial property/land valued at more than RM2 million (based on market price).

(iv) Earn more than RM500,000 (total annual taxable supply) from the commercial properties owned (eg: renting).

(ii) Own land larger than 1 acre.

(iii) Own a commercial property/land valued at more than RM2 million (based on market price).

(iv) Earn more than RM500,000 (total annual taxable supply) from the commercial properties owned (eg: renting).

For instance:

The seller is a GST-registered individual whom you intend to purchase a shop lot from at a price of RM500,000. GST of 6% will then be charged to that amount (RM500,000), which you (buyer) will have to pay.

Owning a Property

After going through the daunting task of applying for a loan, purchasing the property and paying the applicable taxes, you are now the proud owner of a property! But what’s next? Well for starters, more taxes of course.

3. Cukai Taksiran/Cukai Pintu (Property Assessment Tax)

The property assessment tax, better known as Cukai Taksiran/Cukai Pintu, is a tax imposed on every household to finance the maintenance and construction efforts of various public infrastructure around the neighbourhood, town or city where the property is located.

These include the costs of cleaning and maintaining drains, road works to repair potholes, replacing broken street lamps and so on. The tax is payable to the local council of the area in which your property is based, such as Dewan Bandaraya Kuala Lumpur (DBKL), Majlis Bandaraya Petaling Jaya (MBPJ), Majlis Bandaraya Ipoh (MBI) etc..

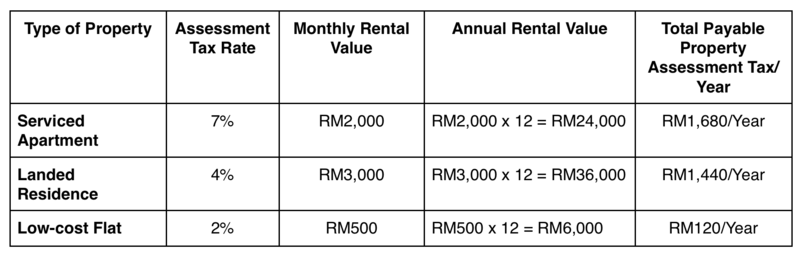

Property assessment tax is evaluated based on the annual rental value of a property set by the state government or local authority where the property is located. Rates vary according to the type of property (eg: residence, serviced apartment, small-office-home-office, flats), location, market rate, and state of the property. (Note:Empty residential and commercial lands are also subjected to this tax.)

An example is as such (according to property assessment tax rates set by DBKL):

*Note: Property assessment tax is payable in 2 instalments, which are on February 28 or 29 for the first half of the year (January to June) and on/before August 31 for the following half of the year (July to December).

4. Cukai Tanah (Quit Rent)

This form of tax is applicable to owners of land, either freehold or leasehold and is an annual tax payable to the State Governments of each individual state. The tax also applies to homeowners of condominiums, apartments and other strata titles. The rates of quit rent may vary between respective states and even within the same state.

It is stipulated in The National Land Code that all payments of quit rent must be made on/before May 31 every year. Individual landowners can pay directly to the Department of Director General of Lands and Mines via online banking while owners of strata titles will have to make payment to the Joint Management Body (JMB) and Management Corporation (MC) of their respective residences/property. The JMB and MC will then submit the collective payment to the land office.

Calculating quit rent:

For example, a house measuring 40’ x 70’ or 2,800 sf:

Selling a Property

5. Real Property Gain Tax (RPGT)

Should you choose to sell your property within 5 years of its purchase, RPGT will be imposed on the net chargeable gains that you get from selling it. Which is the amount of profit leftover after deducting permissible costs from the gross profit, such as legal fees, property agent fees, repair costs etc.. (Note: Remember to keep all records and receipts of these deductibles.)

RPGT is only imposable should the sale or disposal of a property be profitable. If you do not turn a profit from the sale (eg: sold at same price as purchase/lower than purchase price), there is no need to pay for RPGT. Transfer of properties between married couples, a parent and his/her child, grandparents to grandchildren, where there are no gains or losses, is also exempted from RPGT. (Note: There is no exemption in transfers between siblings.)

Rates for the RPGT varies according to the number of years from which the property is disposed of or sold. There are also different rates for Malaysians and Permanent Residents of Malaysia, non-Malaysians as well as companies.

The RPGT was recently amended in the country’s 2015 Budget, whereby new rates are as follows:

Calculating RPGT:

For example, you (a Malaysian) buy a property on October 1st 2011 at a price of RM300,000. In October, 2016 you sell the same property for RM600,000. Hence, the rate that will apply to you is 15% as it is the 5th year of ownership.

*Note: Each individual is allowed a one-time only exemption from RPGT in the disposal of a residential property. This exemption is not applicable to commercial properties.

Taxing Effort Required of Property Owners

Despite how taxing it may be to go about knowing which taxes apply to your property, calculating how much tax you have to pay and even who to pay to, paying taxes is the responsibility which comes with property ownership.

Hence, owning a property takes more than just money, it also takes effort and ample knowledge. It is hoped that this simple guide can help property owners (especially first-time buyers or owners) manoeuvre the overwhelming sea of stamp duties and GST to tackling the waves of property assessment taxes and quit rent until finally, sailing smoothly pass the Real Property Gain Tax (after 5 years that is).

source: https://www.propsocial.my/topic/858/5-vip-very-important-painful-property-taxes-all-malaysians-should-know-posted-by-propsocial-editor?utm_campaign=website&utm_source=sendgrid.com&utm_medium=email