OVERNIGHT POLICY RATE REDUCED !!!

13th July 2016, Bank Negara Malaysia (BNM) announced a drop of 25 basis points in the Overnight Policy Rate (OPR) in their bi-monthly Monetary Policy Meeting. Most analysts hold the opinion that the OPR should have been increased due to the impending increase of interest rates in the United States of America (USA). End of 2015 and earlier this year, I have been sharing my view with members that the OPR should be reduced in Q3 or Q4 2016, a prediction that has been materialized.

Overnight Policy Rate (OPR)

The OPR is an interest rate/profit rate at which a bank lends to/receives from investment with another bank. OPR is determined by Bank Negara Malaysia (BNM) in the Monetary Policy Committee Meeting held throughout the year. In Malaysia, changes in the OPR trigger a chain of events that affect the Base Rate (BR), Base Lending Rate (BLR), short-term interest rates, fixed deposit rate, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services ,which are the micro and macro effects on the economy.

The OPR has been trending at as low as 2% during the global financial crisis in 2009, and as high as 3.5% between 2006-2008. Below is the OPR trend for the past 10 years. Does this spark the start of an era of lower interest rates or is merely a one-off change? Before we discuss more on this, let us further understand the impact of the decrease of the OPR.

Source: Bank Negara Malaysia, July 2016

Impact of Reduced OPR

1. Influence on BR and BLR

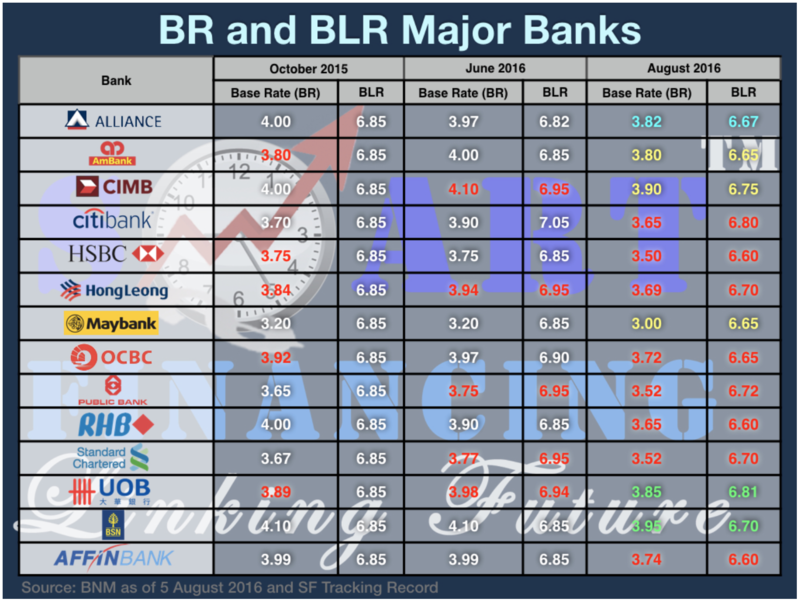

There is a direct influence on the Base Rate (BR) and Base Lending Rate (BLR). When the OPR is reduced, it is stated in the Reference Rate Framework that BR and BLR will have to reduce in tandem of the OPR changes. This means reduction of OPR will directly reduce our effective lending rate (ELR) on existing loans which are using this floating rate. In other words, we are now charged with a cheaper interest rate. Below is the previous and latest BLR and BR rates:

2. Reduced instalment rate

Lowering the OPR reduces the ELR for existing loans, also meaning a lower instalment rate. This lower instalment will lead to better affordability to consumers as well. In banks, affordability is measured by the Debt Service Ratio (DSR), whereby the DSR will also reduce in view of lower interest rates. This means that now your affordability has increased and your chances of getting a loan approval are higher!

3. More profits for banks

However, this may not be good news for those who have yet to obtain a housing loan. It is foreseeable that most banks will be adjusting their spread with new BR loans offered to be similar or close to an ELR of 4.40% to 5.10%. This means now the banks stand to enjoy a better profit margin when giving out housing loans.

4. FD rates to follow suit

The rate of Fixed Deposits (FD) usually follow suit with the changes to the OPR. With a reduction of the OPR, FD rates set by banks have also lowered. This lower FD rate may prompt consumers to look for other alternative investment tools that can offer better returns. Consumer who do not take such actions may be impacted by the drop in deposit interest rates while in view that prices of goods and services might also continue to soar due to inflationary pressure, especially when the inflation rate is higher than 3%.

5. Higher spending power

As instalment rates reduce, this would mean that we can have additional cash on hand every month to spend in other aspects. This increases our spending power, which will potentially boost the economy.

6. Ringgit to weaken

In most instances, the OPR in other countries are normally used as a monetary policy tool to strengthen a country’s currency value. Hence, with the drop in the OPR by BNM, this would weaken the Ringgit against other currencies.

Must bank reduce my housing loan instalment amount?

In view of the reduction of BR and BLR by 14bps to 25bps (varying by bank) on the existing floating rate of housing loans, all banks are required to make adjustments to your monthly instalment, instead of making changes to your existing loan tenure. This is clearly stipulated in the BNM guidelines (as seen below). Even though by default, banks will be lowering your monthly instalment, they will normally give you the option to shorten your loan tenure instead of reducing the amount of monthly instalment you pay.

Conclusion

The OPR reduction is certainly a good news to all. Though a reduction of interest rates was expected to weaken our Ringgit, the move had proved otherwise, where the Ringgit rallied against other major currencies after the announcement of the OPR reduction, while Bursa rebounded from negative territory as well. This demonstrates that most people are delighted with the change, and now you know, especially for ordinary home owners like you and me. It is certainly a pleasing fact that the amount of monthly instalment of our home loans are reduced, this also meaning we have can have more money to spend! Last but not least, BNM may further adjust the statutory reserve requirement towards the fourth quarter of 2016 and may possibly reduce the OPR again in the first quarter of 2017, which we shall look forward to seeing whether they do.

source: https://www.propsocial.my/topic/867/opr-has-been-reduced-posted-by-propsocial-editor?utm_campaign=website&utm_source=sendgrid.com&utm_medium=email

No comments:

Post a Comment